Resources & guidance to help you

make the most of your money

Planning for the Sandwich Season of Life

Can you believe it’s almost October already? It feels like we were just planning summer vacations, and now we’re watching leaves change and pulling out our sweaters. It’s also Open Enrollment season! It’s the perfect reminder that preparation isn’t just about choosing the right health plan—it’s about taking a step back and honestly assessing what the next year might bring.

Many of us find ourselves in what is often called the “sandwich season” of life. Our children are spreading their wings, becoming the adults we’ve been preparing them to be, while we’re watching our parents more carefully, noticing they might need extra support. It’s a lot to hold—the worry of launching young adults alongside the love and concern we feel as we see our parents aging.

The best preparation isn’t about having perfect plans for every scenario. It’s about building adaptability and communication into our families and our lives. It’s about having those sometimes-difficult conversations before we need to and creating systems that have the flexibility we may need.

But reading about preparation is just the first step. The real magic happens when we sit down together and look at your unique situation. Whether you’re wondering about insurance coverage, long-term care options for parents, or supporting a young adult while protecting your own retirement—let’s schedule time to review your plans together and make sure you’re truly prepared for whatever this next chapter brings.

Betty

Betty’s Smart Friends – 2 Important episodes dropped in September!

Speaking of preparation, if you haven’t caught our two most recent podcast episodes, they’re essential listening for anyone navigating this season of life.

- First, I had an eye-opening conversation with estate attorney Amy Danneil about the costly mistakes that could destroy your family’s wealth—with revelations about how many families lose more to preventable estate planning errors than market downturns.

- Second, I spoke with Kylee Bandy, CEO of After Loss Advisors, about the hidden chaos grieving families face—from tracking down forgotten passwords and digital assets to managing overwhelming legal documents when they’re least equipped to handle them. She reveals how specialized support during this vulnerable time can spare families unnecessary heartache.

Both episodes tackle topics we’d rather avoid but absolutely can’t afford to ignore—the kind of preparation that protects the people we love most.

Listen in on Apple Podcasts, Spotify or my YouTube channel @bettyfinancial.

Exciting – I’m in the news!

I’m excited to share that I was recently quoted in MarketWatch’s article “The kids are out of the house, and I saved for college. How are they still spending so much of my money?” The piece explores how hidden college costs like entertainment, transportation, and travel home can catch families off guard—even when tuition is covered.

In the article, I emphasize the importance of having upfront conversations about financial responsibility: “Talk with the student about financial responsibility and what kind of financial help you will or won’t provide.” If you’re navigating college expenses with your family, please reach out if you’d like to discuss creating a college financial plan that works for you.

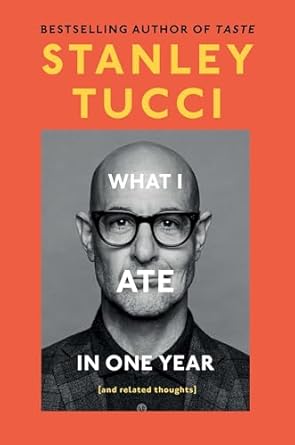

What I’m Reading (And Absolutely Loving!)

I just finished Stanley Tucci’s latest book, “What I Ate in One Year (and related thoughts),” and it was absolutely perfect for someone who’s obsessed with both food and travel. Tucci chronicles an entire year of meals—from intimate dinners at home to meals on film sets to incredible restaurant experiences across Rome, London, and Dublin. What I loved most is how he weaves together the simple pleasure of sharing food with thoughts on family, loss, and connection. It’s like having the most charming dinner companion tell you stories about every meal he’s had! If you loved his CNN show “Searching for Italy” as much as I did, this book feels like the perfect companion—part travel diary, part cookbook, part meditation on how food shapes our lives.

What I’ll Watch (When I Finally Get a Moment!)

Life has been absolutely crazy lately for me—between work & family—but I’ve been looking forward to some well-deserved TV time! I’m beyond excited that The Morning Show is back!! WHAT happened to Bradley?!?!

I also hear I need to watch “The Studio.” Everyone says it is brilliant and very funny. Have you seen it? Let me know if I should make time for it??

#Financial Check-in: Money Confidence for 2025

As 2025 moves on, I’m always here to schedule a conversation to ensure you have both the confidence and clarity needed to move forward purposefully. Just let me know!

Disclosures: BW Financial LLC dba BW Financial Planning is an Investment Adviser registered with the State of Colorado. All views, expressions, and opinions included in this communication are subject to change. This communication is not intended as an offer or solicitation to buy, hold or sell any financial instrument or investment advisory services. Any information provided has been obtained from sources considered reliable, but we do not guarantee the accuracy or the completeness of any description of securities, markets or developments mentioned. We may, from time to time, have a position in the securities mentioned and may execute transactions that may not be consistent with this communication’s conclusions. This communication is for informational purposes only and should not be construed as legal, accounting and/or tax advice. Should you have any questions and/or issues in these areas, please consult your legal, tax and/or accounting adviser.

CATEGORY

10/01/2025