Resources & guidance to help you

Make the most of your money

Defining Wealth in Your Terms

Wealth means different things to different people. For some, it’s all about luxury—fancy trips, designer clothes, and homes on the beach or in the mountains. For others, it’s being able to provide for their family, send their kids to college, and retire comfortably. As we age, our idea of wealth changes too. We go from thinking money is the only measure of wealth to valuing things like happiness, freedom, and stability. Don’t get me wrong! I love luxury too! But as I get closer to 50 (yikes!), I realize that wealth means more than just my net worth. In this blog post, we’ll look at how you can find out what wealth means to you. So let’s jump in!

1. Identify what wealth means to you and how it’s impacted your life.

For me, wealth means feeling secure and free. It’s about being able to provide my family with a stable foundation while also pursuing my passions without worrying about money. Growing up, my family constantly worried about money, and that made things tough sometimes. But it taught me the importance of hard work, saving, and investing in my future. I used to get too caught up in the numbers game, always trying to measure my worth by my bank account. Now, I (try to) focus on being financially responsible and making choices that align with my values and long-term goals. Money isn’t everything, but having financial stability has definitely had a positive impact on my life.

2. Examine what money means to you and how it affects your relationships with others.

Money is a huge deal in our lives, and it affects more than just our bank accounts. It’s tied up with our sense of self-worth, our goals and desires, and even our closest relationships. It’s totally normal to feel a bit overwhelmed or conflicted about money. But taking the time to think about what it means to you can help you build a better relationship with it – and with the people around you. Whether you’re stressed about finances, dealing with a tricky partnership, or trying to navigate a complicated financial landscape, just know that you’re not alone. With some reflection and help from your support system, you can build a more balanced, fulfilling relationship with money – and with the people who matter most.

3. Explore different views of wealth – material vs non-material, intrinsic vs extrinsic.

Wealth is a complex topic that leaves many of us with differing opinions. Some consider material possessions as a symbol of wealth, while others believe that non-material aspects such as good health, quality time with family and friends, and personal growth are the real assets. In the same vein, some people believe in extrinsic rewards like money, fame, and social status, while others would instead have intrinsic rewards like inner peace, a sense of purpose, and self-fulfillment. It’s essential to understand and appreciate different opinions and approaches towards wealth. After all, the accumulation of wealth should be a means of achieving happiness, and we all have different paths towards that goal.

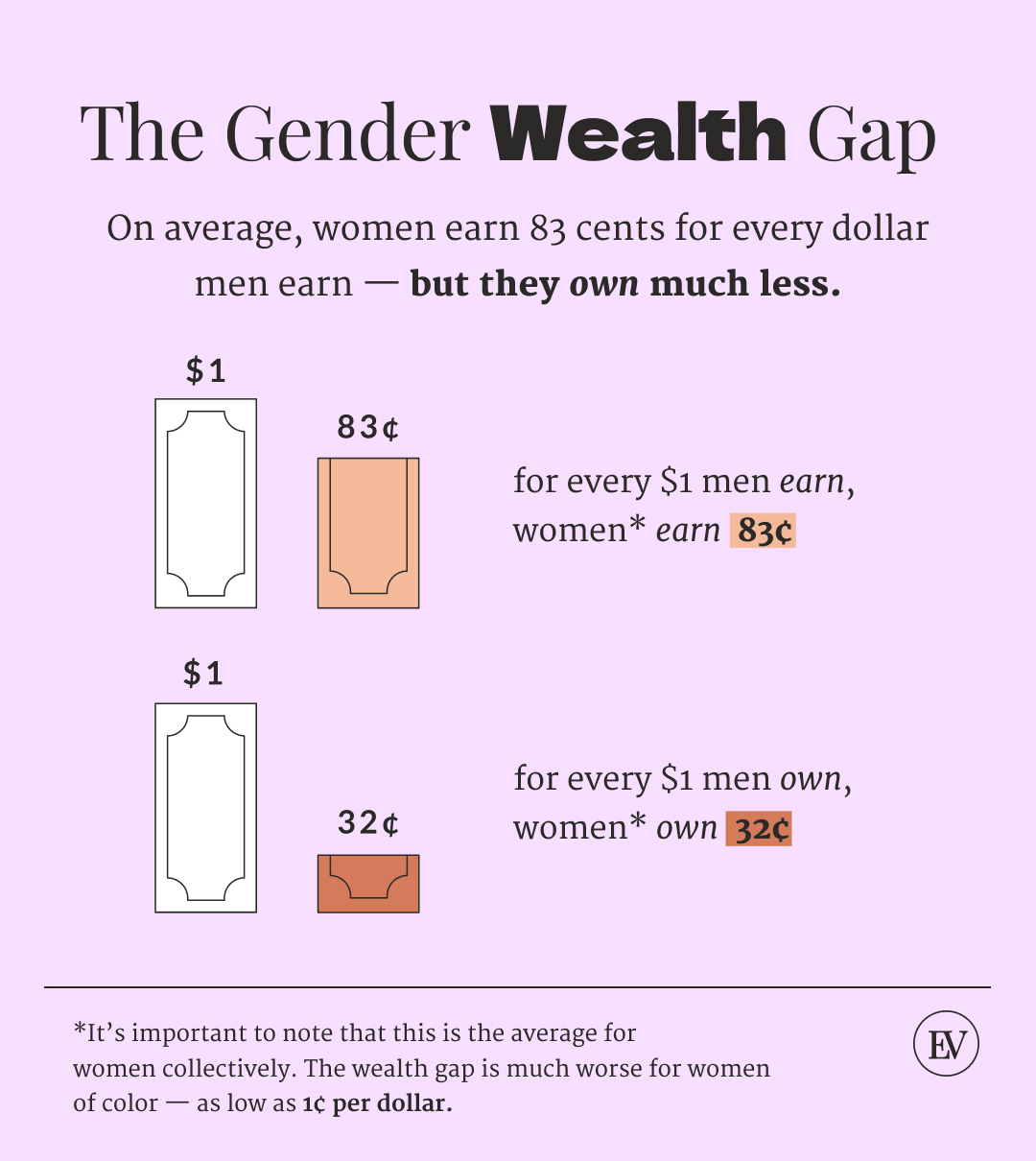

4. Understand how gender impacts views of wealth.

Let’s talk about gender and wealth! It’s a big deal, and it shapes our perspectives in some pretty significant ways. Unfortunately, gender expectations can lead to biases and misconceptions about money. Women often say “I’m bad at money” – but who told them that? And why do they believe it? As we push for true gender equality, it’s vital to recognize these challenges and work to overcome them. By acknowledging how gender impacts our views of wealth, we can start paving the way for a more inclusive and supportive financial landscape. Whether you’re just starting out or are well on your way, know that you’re not alone in this journey. We can work together to break down barriers and build a brighter, more equitable financial future for everyone!

5. Consider the importance of financial literacy and budgeting to build wealth.

Building wealth can seem pretty daunting, but with the right tools and mindset, it’s definitely doable. A big part of any successful wealth-building plan is being financially literate and budgeting like a boss. Without a good grasp of personal finance, it’s tough to make informed decisions about where to spend and save. Budgeting helps us keep track of our expenses and identify areas where we can make adjustments, ultimately leading to savings and a brighter financial future. The more we learn about our finances and practice budgeting, the more we empower ourselves to achieve long-term goals and grow our wealth. Just remember, building wealth takes patience, perseverance, and a strong financial foundation.

I get it – most women hate the “B” word… Budgeting. But what if we changed our mindset and called it a “Mindful Spending” plan instead? That way, we feel more in control and empowered to make choices that align with our core values and what we hold most dear in life. So, let’s spend mindfully on the things and experiences that matter most!

6. Discuss ways to create a healthy relationship with money.

Money = Feelings

Money can be a tricky subject that brings up a lot of emotions, but you know what? Building a healthy relationship with it is totally possible! One way to start is by getting clear on your values and priorities. Just ask yourself: what’s important to me? Then, make sure your financial decisions align with those things. Another way to get on track is by setting both short-term and long-term financial goals. Maybe you want to pay off that pesky debt, save for an epic trip, or contribute to your retirement. Whatever it is, celebrate milestones along the way, and don’t be too hard on yourself if you slip up. Finally, remember that money is not the end-all, be-all. It’s just one aspect of your life, and it doesn’t define your worth. So, be patient, stay intentional, and give yourself some grace. You got this!

Talking about wealth and how we see it can be a tricky and personal topic, especially for us ladies. But it’s important to take the reins on our financial literacy, budgeting habits, and mindset towards money. That way, we can eliminate any limiting beliefs and make our dream lives a reality. We all have our own definition of wealth, and that’s okay. But it’s crucial to understand how it shapes our present and future. With a bit of mindfulness, talking things through with loved ones, and being open to different views on wealth, we can develop a healthy relationship with money that helps us lead fulfilling lives.

Disclosures: BW Financial LLC dba BW Financial Planning is an Investment Adviser registered with the State of Colorado.All views, expressions, and opinions included in this communication are subject to change. This communication is not intended as an offer or solicitation to buy, hold or sell any financial instrument or investment advisory services. Any information provided has been obtained from sources considered reliable, but we do not guarantee the accuracy or the completeness of any description of securities, markets or developments mentioned. We may, from time to time, have a position in the securities mentioned and may execute transactions that may not be consistent with this communication’s conclusions. This communication is for informational purposes only and should not be construed as legal, accounting and/or tax advice. Should you have any questions and/or issues in these areas, please consult your legal, tax and/or accounting adviser.

CATEGORY

6/29/2023