Resources & guidance to help you

Make the most of your money

Find the Right Financial Advisor for YOU

After reading last month’s blog Do I Need a Financial Advisor, maybe you are thinking “I do want a financial resource and partner in my corner… Now what?” Yay! If you have been ignoring your personal finances because you don’t have the time or interest, it could be costing you money in real dollars. Finding a financial advisor is a great first step! According to National Financial Education Council, a lack of personal finance knowledge costs the average American $1,800 per individual in 2022. This post will walk you through how to find the right financial advisor for you and your situation.

Three Common Worries

First let’s get some common worries about working with a financial advisor out of the way.

1. I’m worried that I’ll trust the wrong person who will lose or steal all my money.

Unfortunately, the term “financial advisor” has a bad reputation for a reason. There ARE bad folks out there who intentionally sell unnecessary products because they make a fat commission. Or they blatantly lie about the investments a la Bernie Madoff. Many of us also personally know friends or family who have been the victim of an unscrupulous “financial advisor”.

Please know there are good, honest financial advisors who will advise you on what’s in your best financial interest. You just have to know where to find them.

Helpful Tip: If it sounds too good to be true, it usually is. There is no easy way to build wealth.

2. I’m not rich. I don’t have enough money to need a financial advisor.

Nowadays you don’t have to have $1 million to work with a capable financial advisor. There are different business models that serve clients at all levels of wealth. There are robo-advisors, hybrid service models (robo-advisor with limited real person interaction), and human advisors with hourly rates or project-based fees.

You can find a financial advisor who fits your needs and your budget.

3. I am embarrassed to show my finances to someone.

This is something I hear often from women and men. They are worried about what I will think, that I will judge them for what they have done or not done with their money. I guess it is like getting naked in front of a doctor, right? You know they have seen it all before, but you are still self-conscious as hell when you are the naked one.

This is what I tell people who feel this way:

Absolutely no one has perfect finances. You made the best decisions you could at the time with the information you had. Our work together is to educate and empower you with relevant, current information to help you make better financial decisions for yourself. We start where you are.

Red flag alert: If you feel judged when having conversations with a financial advisor, RUN!

How to Start

Decide What You Need Financial Help With

Most women start with investments. They know they “should” be investing their money, but they don’t know enough to feel comfortable to start.

Decide if you only want help with investing? Or would you like a comprehensive financial plan?

Another common issue for higher earners is how to best optimize their income and how to strategize for taxes. In my opinion, tax planning is one of the biggest value-adds that a financial advisor can provide. For most people, taxes are the biggest expense you will have in your lifetime. If you are lucky, your tax preparer helps you with this planning. But as CPAs get inundated with tax law changes, tax planning can be lost in the shuffle.

Financial advisors can also be helpful with budgeting, college funding, and retirement planning.

Determine What Type of Relationship You Want

Do you like having an accountability partner? Or are you good with implementing once you have a to-do list in front of you? Do you prefer to have someone walk through the why’s and how-to’s? Or are you okay with having a chatbot talk you through?

While this blog focuses on how to find a human advisor, robo-advisors can be a suitable choice for some women.

Robo-advisors (“Robos”) like Ellevest and Betterment provide automated, lower cost investment advice. It can be great for folks who are tech savvy and don’t need in-depth advice on insurance, retirement, and taxes. Higher net worth individual may have access to a financial planning call center. Or you may be able to pay additional fees to talk to a human.

From a service standpoint, the main benefit of a human advisor is personalized advice and a personal relationship. Some financial advisors offer a holistic financial plan in addition to investment management. We strategize with you on tax, retirement, and estate planning. Additionally, we offer ways for you to optimize your income and your employee benefits at work. If you have a complex financial situation like stock compensation or inherited wealth, my recommendation is a human advisor. There are so many changes in the industry that you don’t want to risk getting an uninformed agent from the call center. Unfortunately, this happens, and there is no recourse.

Important Questions to Ask

There are many capable, honest financial advisors out there who don’t meet the criteria I outline below. However, if you are starting from scratch, these criteria will give you the highest probability of finding a financial advisor you can trust. I am always happy to provide referrals to good people I know and trust if you need a place to start.

Are you always a fiduciary? Is this written into your contract?

You want to hear Yes! and Yes!

This is a sad one for a couple of reasons. Being a “fiduciary” is a legal representation that the advisor must act in your “best interest”, which is the highest standard of care. Or you can sue them.

First, it is sad that not all advisors look out for their client’s best interests. Second, it is sad that you must confirm that “fiduciary” is written in their contract with you. Some advisors say they are fiduciaries, but don’t put it in writing. That defeats the purpose of you being legally protected… Hmm…

You also want to be extra cautious with some of the larger, well-known firms that separate out the Financial Advisory arm from the rest of their businesses. This is so financial advisors in the firm can technically say they are “fiduciaries”. However, these same financial advisors have financial incentives to sell the firm’s proprietary products. They have internal contests with prizes for whoever has sold the most Flavor-of-the-Month product that the firm is pushing.

Tricky, right? As I said, the financial advisory industry is responsible for its own bad reputation.

How do you get paid?

Here you are looking for the words “FEE-ONLY”.

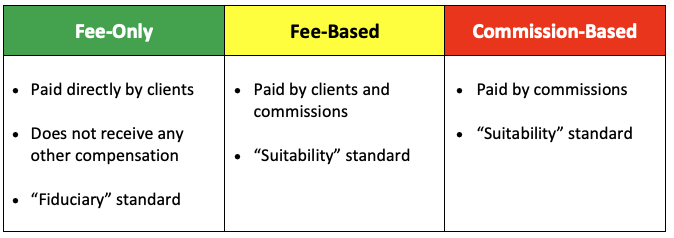

There are three primary ways an Advisor can get paid:

Fee-Only (**Gold Standard**)

Fee-only is the gold standard of transparency in fees. No commissions. No product sales. No hidden third-party referral fees. You pay the advisor directly for their services. Nothing is hidden.

A fee-only advisor doesn’t mean you won’t be paying for the service or that they are “cheap”. What it does mean is that you will know exactly what you are paying and when you are paying it. Fees may charge on a sliding scale on the assets they manage for you, as a flat rate, or on an hourly basis.

These advisors are incentivized to provide you the best service because they earn their living based on what you pay them and if you continue to want their services. While there are still conflicts of interest, this type advisor has the least amount. Read more here.

Fee-Based (Not Recommended)

Fee-based financial advisors get paid via fees and commissions.

Here you run into the same conflicts of interest and lack of transparency as you do with advisors who are paid by commissions.

Commission-Based (Avoid)

Commission-based advisors are exactly what they sound like. They are paid on products they sell, trades they make, and/or referrals they give. There is usually zero transparency on how or what you are paying unless you explicitly ask. Even then, you may not get a straight answer.

This is not necessarily bad, but you should be cautious. They are financially incentivized to sell you what they can, not necessarily what is best for you. Commission-based advisors cannot be “fiduciaries”. They are held to the “suitability” standard. Are you okay with “this recommendation is suitable for you”? IMHO,

“this recommendation is what is best for you” is how I want my money managed.

When you hear people say “I don’t pay anything” to my financial advisor. This is very, very wrong. They just don’t know what they pay because they don’t see a bill. This is intentional. In business, it’s called “reducing friction”. The intent is to have the least amount of friction, so clients keep paying without questioning how or how much they are paying.

A client came to me from a financial advisor at a well-known insurance company. She asked him to detail what exactly she paid in fees per year. He didn’t know. She asked for a ballpark figure. He responded with it was too complicated for him to figure out. Hmm…

Good financial advice is worth its price. Always be suspicious when something seems “free”.

What are your credentials?

Look for CERTIFIED FINANCIAL PLANNER™.

Anyone can use the title “financial planner” or “financial advisor” (these terms are often used interchangeably) without any formal education, certifications, or relevant experience.

Only those who have fulfilled the certification and renewal requirements of CFP Board can display the CFP® certification trademarks which represent a high level of competency, ethics, and professionalism. A CFP® professional has special technical expertise with regards to retirement, estate, tax and investment planning. However, the real skill comes in the ability to bring all these pieces of a person’s financial life together.

Other respected designations with continuing education and ethics requirements are Certified Financial Analysts and Certified Public Accountants.

What else should I consider when evaluating the right financial advisor for me?

Having the right financial advocate and partner can go a long way towards ensuring a comfortable future. Jason Zweig, regular contributor to the Wall Street Journal, has an excellent article titled “The 19 Questions to Ask Your Financial Adviser” to help in the search for the right financial planner.

Research the financial advisor. Look for red flags like disciplinary actions through FINRA’s BrokerCheck. Check out their websites.

The final comment is to trust your gut. We, women, are super intuitive. After you have talked to a few qualified candidates, chose the person you are most comfortable with.

Where to Search

These organizations require members to be Fee-Only and Fiduciaries. They are great places to start your search.

XY Planning Network (“XYPN”)

National Association of Personal Financial Advisors (“NAPFA”)

Garrett Planning Network – for hourly and project work

Bonus Question

What’s the difference between a financial advisor and financial planner?

In the industry, “financial advisor” and “financial planner” are commonly used interchangeably, but there are some differences. Most financial PLANNERS advise on your overall financial situation including investments. Most financial ADVISORS only advise on investments. Sometimes they may offer a “Financial Plan Lite”. People tend to be most interested in investing because it’s what they hear about from friends or the media. Your overall financial plan is just as important, if not more so, than investments. My 23-year-old self still can’t believe I said that. But it’s true.

An easy way to weed out folks who are investment-only is to look at the name of the firm. If it has financial planning in the name, then your full financial picture will be addressed, not just your investments.

Read this if you want to learn more about all the different types of financial advisors are out there and all the different titles that they can use. It’s so confusing.

Disclosures: BW Financial LLC dba BW Financial Planning is an Investment Adviser registered with the State of Colorado.All views, expressions, and opinions included in this communication are subject to change. This communication is not intended as an offer or solicitation to buy, hold or sell any financial instrument or investment advisory services. Any information provided has been obtained from sources considered reliable, but we do not guarantee the accuracy or the completeness of any description of securities, markets or developments mentioned. We may, from time to time, have a position in the securities mentioned and may execute transactions that may not be consistent with this communication’s conclusions. This communication is for informational purposes only and should not be construed as legal, accounting and/or tax advice. Should you have any questions and/or issues in these areas, please consult your legal, tax and/or accounting adviser.

CATEGORY

3/02/2023