Resources & guidance to help you

Make the most of your money

Do I Need a Financial Advisor: 8 Questions to Ask Yourself

Do you ever wonder if you need a financial advisor? “Financial advisor” is a generic term and can be confusing. When I use the term financial advisor, I’m referring to professionals who do comprehensive financial planning and investing. I’m not talking about someone hawking the latest investment or insurance products. In my blog next month, I’ll write about how to find the right financial advisor for you. But first, let’s determine if you need one.

Here are 8 questions to ask yourself:

1. Do I worry about money?

Most humans worry about money. But do these worries intrude into your everyday life more than you’d like? What about money worries you? What actions are you taking to alleviate these worries?

Some people cope with money worries by ignoring them and hoping they go away. Others may cope by being hyper vigilant and focusing on making as much as they can or spending as little as possible. Neither strategy is very helpful in alleviating the worry because they are not addressing the real issues. This leads us to the next question.

2. Am I clear about what is important to me about money?

“What is your Financial Why” is another way to ask this question. There are no right or wrong answers. Knowing your Financial Why’s can help you determine your financial worries. From there, you can tackle each worry individually.

By asking good questions, a financial advisor can help you clarify what is important to you about money. She can also provide education and create a personalized plan to help you move forward toward the life you want.

3. Do I enjoy learning about money?

Easy question. You either do or you don’t. If you don’t, outsource. Just like other tasks you don’t enjoy. Your financial health is too important to be ignored or put off for another day.

If you do, great! Check out the next question.

4. Do I have the time to deal with my money?

We are all busy people. Do you have time to go down Google blackholes when you have a money question? How much time do you spend overthinking which financial advice suits your personal situation?

Do you have time to figure out what paperwork you need to set up accounts? Or sit on hold with a provider (Vanguard, Fidelity, etc.) to get your questions answered?

Are there other things you’d rather be doing with your time?

5. Am I going through a life transition like a job change, divorce, or widowhood?

Typically, people reach out to financial advisors for the first time when they are experiencing a life change or transition. They realize they don’t have the financial knowledge to navigate a new situation. And sometimes, they aren’t emotionally equipped to deal with one more task on their never-ending to-do list. They need a helping hand in prioritizing what decisions are important and what can wait.

6. I’m smart. Shouldn’t I be able to do this myself?

A common theme I hear, especially from women, is that they are embarrassed or ashamed that they don’t know more about money. Of course, you are smart! You have the capacity to learn what to do with your money. But this is what we, financial advisors, do as our profession with years of education and experience.

Think about what you do for a living. Could someone without your education and your experience be as good as you at your job? Probably not. Think of your role as the Chief Operating Officer of your household. Absolutely one could do your job as good as you! Even if you’d rather that someone else did. ?

There are many different strategies and tactics that you can use to achieve your financial goals. It’s not a one size fits all situation. Adding to the complexing is the continuously changing financial landscape. A good financial advisor will educate you on why she is recommending a course of action and walk you through the pros and cons. She’ll be up to date with changes on the horizon, so you don’t have to be.

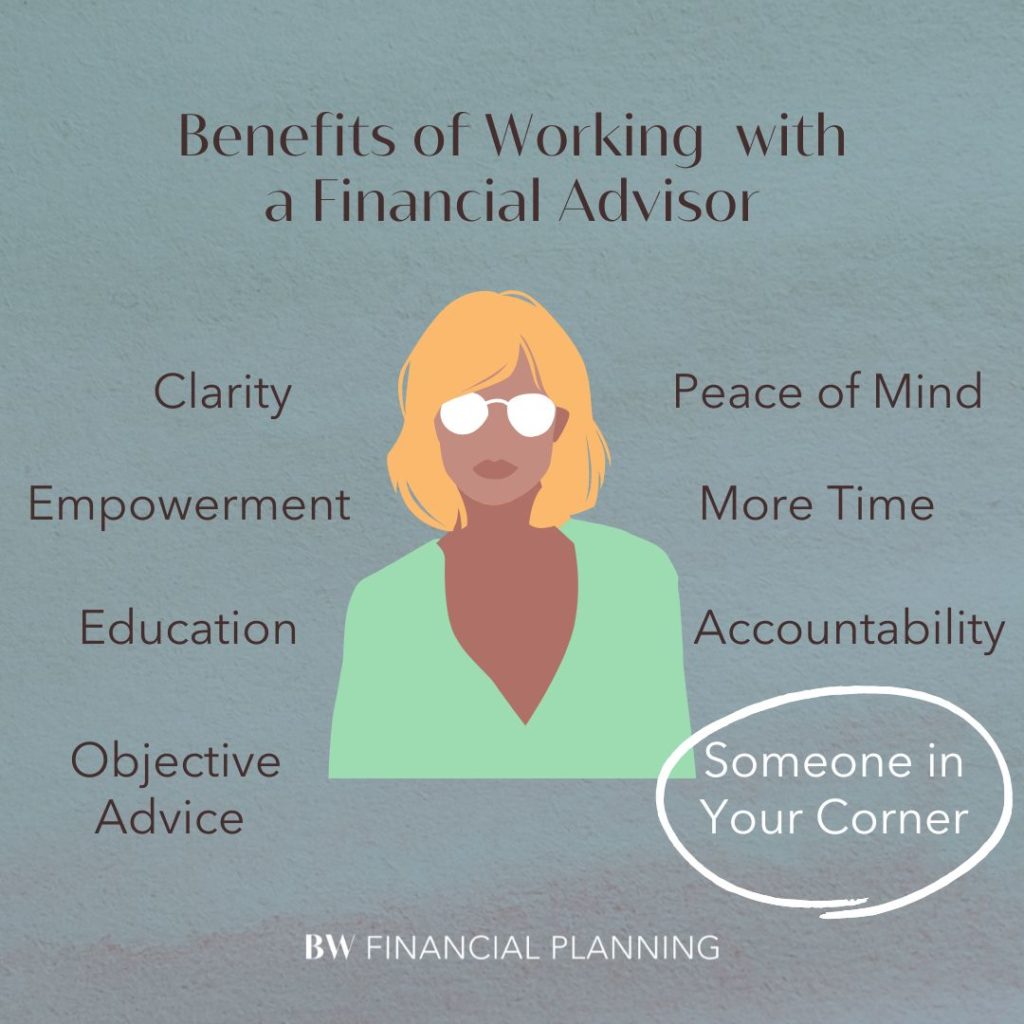

7. How do I benefit from having a trusted financial advisor?

The number one benefit I hear from clients is that they have peace of mind and less uncertainty about their futures.

Here are some other benefits:

- You have an objective, knowledgeable financial partner who has your back

- You have less stress about money and feel you are on the right track

- You are more educated and empowered in your financial situation

- You have more time to focus on your family, friends, career, and hobbies

8. What risks am I taking if I don’t have financial advisor?

- You may make a mistake that adversely affects your financial situation

- You may not take advantage of financial planning opportunities that are available

- You may not be adequately prepared for financial curveballs

There are no right or wrong answers to these questions. Whether or not you “need” a financial advisor is based on if you think the benefits outweigh the risks and costs. If you think you might be in the market for a financial advisor, next month we’ll talk about how to find the right fit financial advisor for you.

Let me know if you have any questions. Here if you want to talk personally.

Disclosures: BW Financial LLC dba BW Financial Planning is an Investment Adviser registered with the State of Colorado.All views, expressions, and opinions included in this communication are subject to change. This communication is not intended as an offer or solicitation to buy, hold or sell any financial instrument or investment advisory services. Any information provided has been obtained from sources considered reliable, but we do not guarantee the accuracy or the completeness of any description of securities, markets or developments mentioned. We may, from time to time, have a position in the securities mentioned and may execute transactions that may not be consistent with this communication’s conclusions. This communication is for informational purposes only and should not be construed as legal, accounting and/or tax advice. Should you have any questions and/or issues in these areas, please consult your legal, tax and/or accounting adviser.

CATEGORY

2/02/2023