Resources & guidance to help you

Make the most of your money

How Much Money Is Enough

Happy New Year!

Every new year there is pressure to have grand plans of a whole new YOU! We are bombarded with ads: “If you lose 10 pounds, you will be happy!” “If you invest your money with us, you will be secure!” Sometimes we make resolutions without really thinking about them. However, research shows that we humans are not great (we’re actually pretty darn bad) at making goals that bring us happiness in the long run, which is why we eat too much, save too little. Before you jump into making resolutions, I challenge you to take a step back first.

What is truly important to you and your life? What are your personal values and objectives?

These are big and overwhelming questions. Ones that we don’t think about very often, and, for most people, aren’t questions we ask ourselves when talking about money. When it comes to money, more is always better, right?!?

Listen, I’m not a fan of woo-woo stuff but if it works, it works. Try these three George Kinder questions below to help get the ball rolling:

- Imagine you are financially secure, that you have enough money to take care of your needs, now and in the future. How would you live your life?

- Now imagine that you visit your doctor, who tells you that you only have 5-10 years to live. You won’t ever feel sick, but you will have no notice of the moment of your death. What will you do in the time you have remaining?

- Finally, imagine that your doctor shocks you with the news that you only have 24 hours to live. What did you miss? Who did you not get to be? What did you not get to do?

If you are partnered, go through these questions solo and then compare notes.

Did you have any a-ha moments? Are you spending your resources – time, energy, money – for the important values in your life?

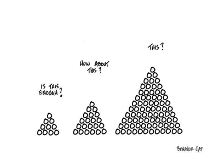

How much money is enough?

A question I hear often from potential clients is “What should my number be?” In other words, how big should my pot of money be so I can get on with enjoying my life? Do you have your own number in mind? Bet you do!

We are a goal-orientated society and think we will be ok once we reach that target. But when you got the work promotion you were gunning for, how long did that feeling of accomplishment last? How long before you started making new goals? The target is always moving.

The question of enough can be particularly difficult for clients who have equity compensation. They don’t want to leave money on the table, money that they earned. “I just want to wait until next year’s shares to vest… until the stock price is higher….”

And at what cost?

What are you giving up or delaying to reach this number? What is the cost of staying until your shares vest or until the market bounces back? Money isn’t the only factor. We forget that other important personal resources are our time and our energy. Where and how we spend our time and what we focus on are significant considerations.

Are you paying with time that could be spent with your family or a job that you find more fulfilling? Are you paying with mental and emotional energy that leaves you too grumpy, resentful, depleted to do anything else?

Recently, I’ve had dear friends lose close friends and family unexpectedly. Some of the people who passed were in their 40’s. Death comes for us all, and we don’t know when. We can get caught up in accumulating money as a resource, as a measuring stick. Maybe as you make resolutions for this new year, consider that your time and your attention are also precious resources to optimize and use mindfully.

If you are interested in reading more on this topic, check out a previous blog on Do I Have Enough to Retire?

Wish you all the best in this new year!!

Disclosures: BW Financial LLC dba BW Financial Planning is an Investment Adviser registered with the State of Colorado.All views, expressions, and opinions included in this communication are subject to change. This communication is not intended as an offer or solicitation to buy, hold or sell any financial instrument or investment advisory services. Any information provided has been obtained from sources considered reliable, but we do not guarantee the accuracy or the completeness of any description of securities, markets or developments mentioned. We may, from time to time, have a position in the securities mentioned and may execute transactions that may not be consistent with this communication’s conclusions. This communication is for informational purposes only and should not be construed as legal, accounting and/or tax advice. Should you have any questions and/or issues in these areas, please consult your legal, tax and/or accounting adviser.

CATEGORY

1/06/2023

POSTED

Read previous

Read next