Resources & guidance to help you

Make the most of your money

Principles of Succesful Investing

Can’t believe it is November! Here are some articles that caught my attention this past week. This week is a little investment heavy. Let me know if there are topics you are interested in learning about!

4 Things That Will Never Change for Young Investors

Even though the world is continuously changing, these 4 principles of successful investing remain true throughout time. Important principles for investors of all ages to grasp????

Inflation Just Reached All Time Highs, and Might Be Even Higher with ‘Skimpflation’

I liked this new word “skimpflation”. If your usual Starbucks order costs a few cents more, this is inflation. If Starbucks made their Grande a couple ounces less for the same price, this is “shrinkflation”. Skimpflation is when you aren’t getting as much service as you normally expect, i.e. waiting longer for your Starbucks or your favorite Starbucks location setting shorter hours because of labor shortages.

Where have you noticed skimpflation in your life?

Risking, Fast and Slow

Fascinating read. Nick Magguilli explains slow risk (fatal lung cancer after years of smoking) versus fast risk (dying quickly from a heroin overdose) and how the different types of risk relate to life and your investing portfolio. With good financial planning you don’t need to worry about the fast risk.

There are some goodies here, but for women, number 11 is particularly true.

If you invest scared, you remain scared

Scared money is the money you absolutely need to survive. That’s the amount of money you need to buy groceries and pay the mortgage. But most people look at all their money as scared money.

Do you invest your money scared?

Internal vs. External Benchmarks

“People play different games, some of which might not be related to your own goals.” Morgan Housel for the win! He proposes we should measure how we are doing by using ourselves as benchmarks rather than using others.

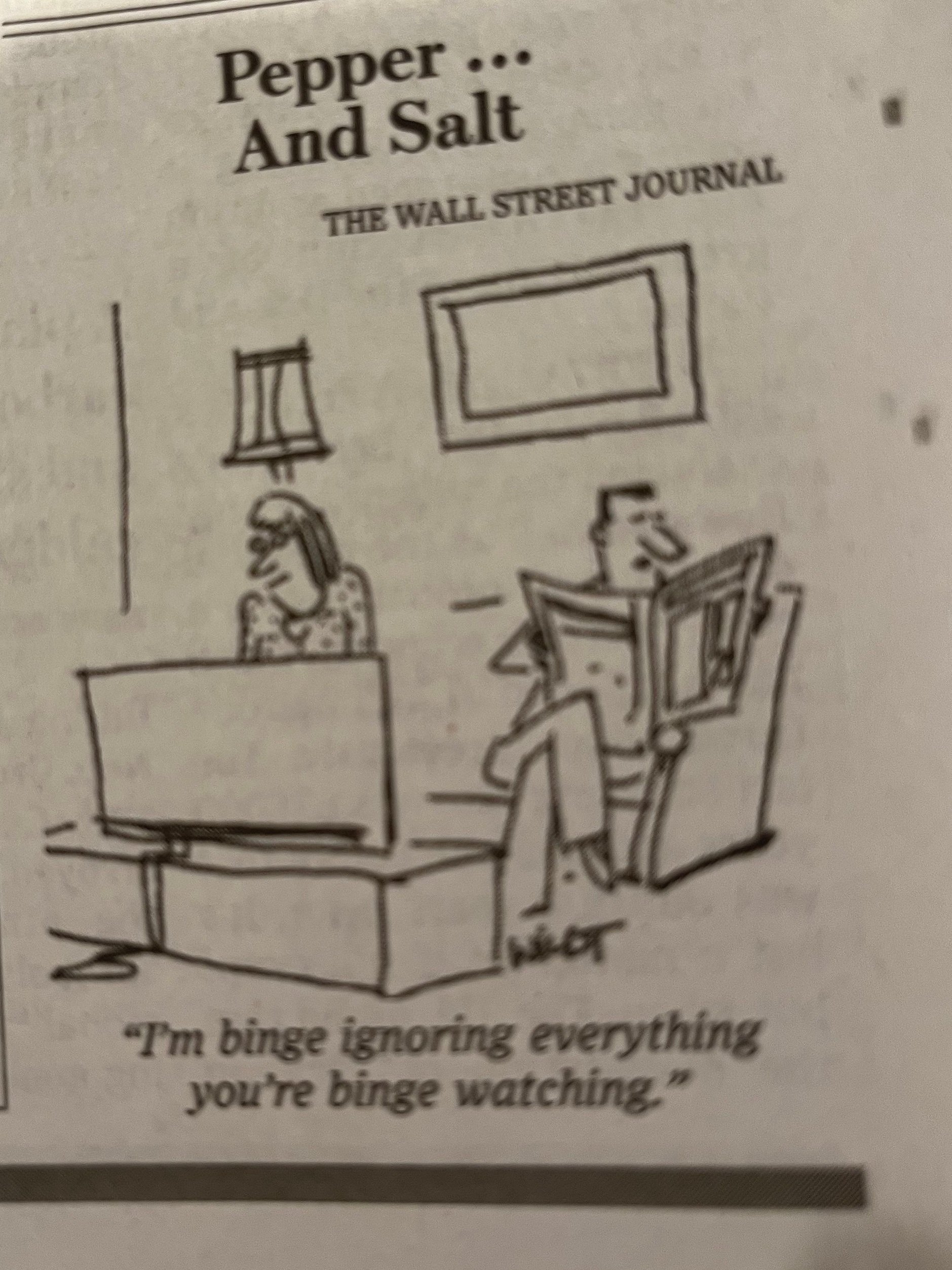

This comic from the Wall Street Journal illustrates my household perfectly. Let me know if you are binge watching anything good!

CATEGORY

11/03/2021